Do students need to register for the courses they wish to attend?

No, students typically do not need to register for the courses they want to attend. Instead, they are responsible for finding out when the first session of the course takes place and simply attending that session to receive further information.

I have been admitted to the program but will not make it to start my studies in the upcoming semester due to extended processing time of my visa application or similar. Can I start my studies in the following semester?

Starting from summer 2025, enrollment is possible both for the summer and winter term.

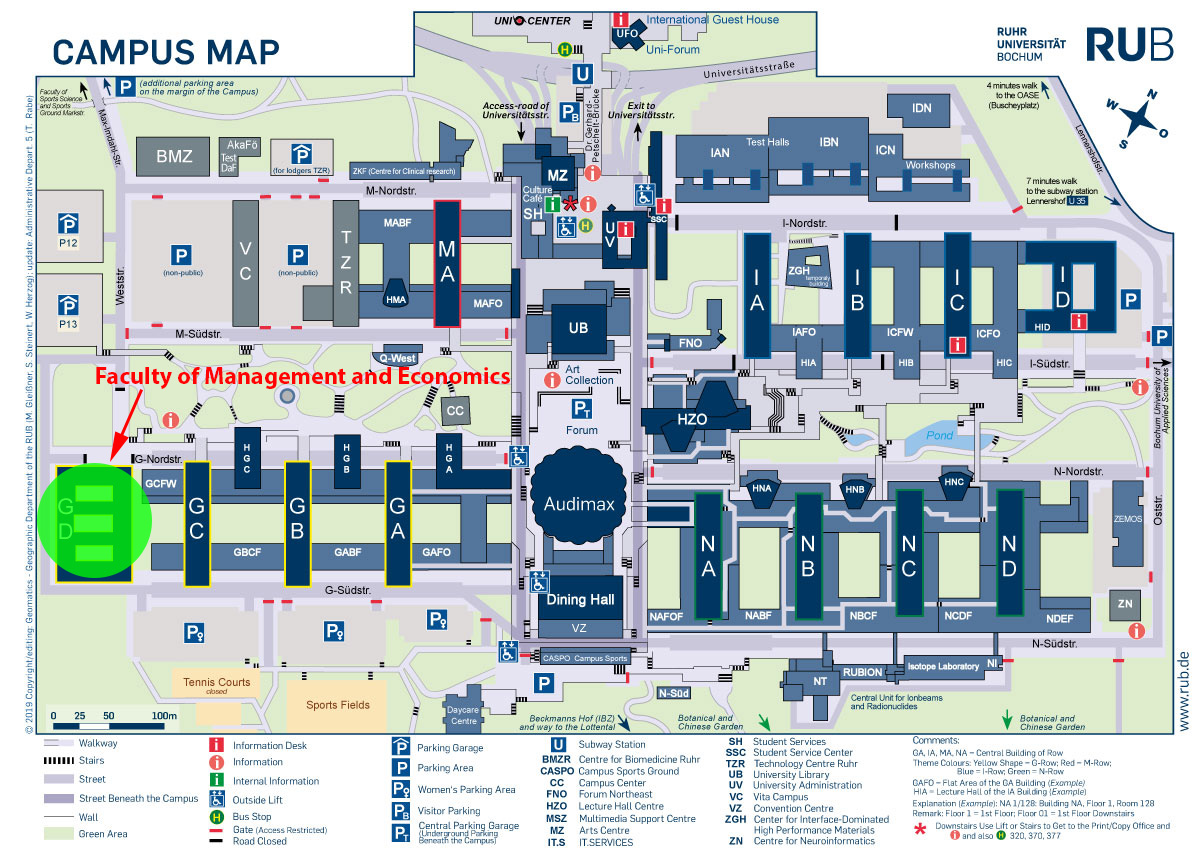

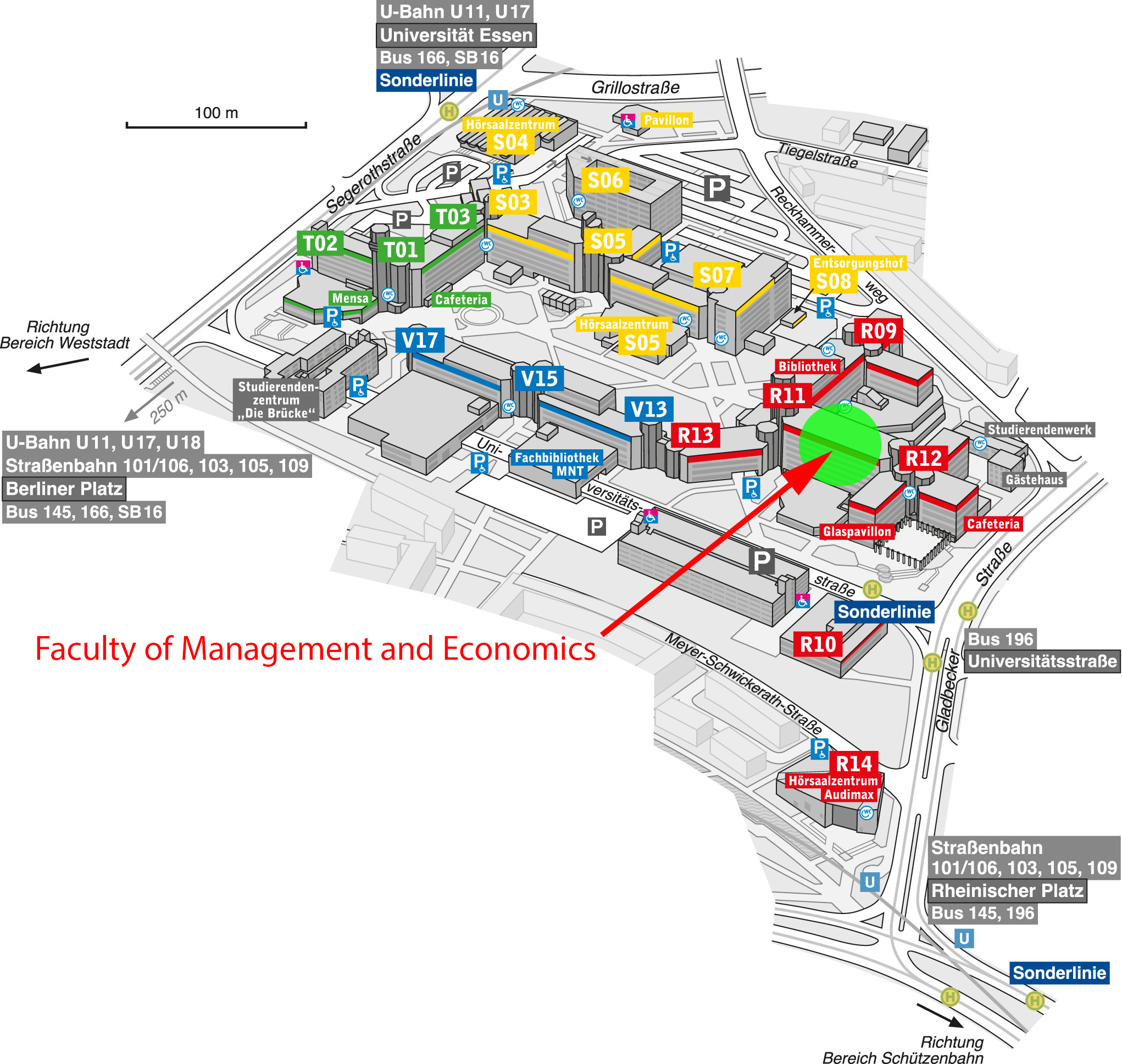

Which university administers the program and offers most of the compulsory courses (base location)?

The base location is in Dortmund. Many of our students therefore have accommodation in Dortmund.

I need to name a contact person for my visa application. How should I proceed?

You may use the following contact information:

- Location of the organisation: TU Dortmund University

- Street: Vogelpothsweg

- House number: 87

- Postal code: 44227

- Location: Dortmund

- (Mobile) phone number: +492317 554676

I am a current student and have seen a course that I would like to take that is not part of the curriculum of the MSc Econometrics.

Please contact the program directors with a syllabus sufficiently prior to the start of the semester in which you want to take the course.

How do graduates of the Econometrics program fare in the Job market?

Our graduates have pursued their careers in, e.g., both international and German PhD programs in statistics, economics and econometrics, large insurance companies, research institutes and consultancies.

The application portal currently appears to be closed. When does the application period for the new academic year start?

It opens once all administrative steps in the backend are complete; usually some time in the spring. Please keep an eye on our websites.

I am a prospective Student from India. Do I need an APS certificate?

Yes: applicants from India have to have their academic certificates checked by the Academic Evaluation Centre (APS India) of the German Embassy in New Delhi before they can apply for German master programs. After a positive review, they receive an APS certificate, which must be submitted as part of the application. See the APS website for further info.

I have already completed a Master’s program in X at the University of Y, but am nevertheless interested in attending the MSc Econometrics. Can I still apply?

Yes.

Am I eligible to apply?

Yes, everybody is eligible to apply. If you are eligible to be admitted will be checked once you submit a full application with all required documents as described here.

Is it possible to take up studies both in the winter and the summer semester?

Yes, enrollment is possible for the winter and summer semester.

I have been admitted to the program on conditions. Does this affect my recommended course of study?

Depending on the conditions imposed, it may be advisable to take pre-courses and, in particular, to complete the core curriculum in a specific order. Please check with us if you are in doubt about the effect of admission conditions on your specific course of study.

In my admission letter, I am being told about a requirement to earn missing qualifications in subject X. I however believe that I have already fulfilled these qualifications. What should I do?

Please contact us to discuss this matter.

I just enrolled. Is there any other recent information that might be helpful to get started in Dortmund?

Yes, we’ve for example got a moodle page for our students. Please contact us for enrolment details.

I would like to refresh my knowledge in statistics before starting my studies. Is there a preliminary course?

We are currently designing a preliminary course. Additional information follows.

I feel that I might need to brush up on my math skills before starting the program. What should I do?

Please contact us for further information and suggestions as to what to do.

Due to the Corona pandemic, it is difficult for me to obtain the required English language certificates at the moment. What can I do?

In this case, please supply any suitable available evidence of your proficiency in English, e.g., other certifications or English-language term papers.

I currently have a job and/or plan to work during my studies. Is it possible to study part-time, thereby saving fees?

While the standard case is that of full-time study, the completion of 30 ECTS per semester (as outlined in the recommended course plans) is not a formal requirement. Each student may decide, depending on their personal preferences and circumstances, to aim for the achievement of a different number of ECTS each semester. This flexibility may of course lead to a longer overall time to complete the program.

Note that there is no official part-time program. Therefore, while you decide for yourself at what pace you study, the semester fees remain the same.

Can I go abroad?

While we do not have a specific exchange program for the MSc Econometrics yet, there are existing exchange programs for the other programs of the participating faculties that you may be able to draw upon. Please contact us for details.

I submitted my application X days ago. When will I hear from you?

We process applications and communicate decisions as soon as they come in. There may however be certain delays as the central administration first checks applications to all programs of the university for issues like completeness, and they have to handle many of these. We therefore kindly ask for some patience.

Does sending my questions to as many email addresses of contact people I can find increase my chances of getting a quick reply?

No. That just causes unnecessary duplication of work and creates further delays! Please see the answer to the question above.

What should I include in the academic CV?

We strongly encourage you to use our Academic CV form where you can fill in a questionnaire and download a PDF version. Please click here to download the form.

Please see the academic CV as an opportunity for you and us to summarize your motivation and suitability for the program. Feel free to include any information, such as prior courses, relevant skills, work experience, career goals etc., that you deem supportive of your application.

My undergraduate grades are just slightly worse than the minimum grade point average (in the German grading system) you ask for. Can I nevertheless be admitted?

Unfortunately, by law, we are not able to make exceptions here, such that we regret to say you cannot qualify for the program. Please note that (also by law) only the Bachelor GPA is relevant even if you already have a Master’s degree.

Is there a maximum number of students you admit each year?

No, there is no cap.

I do not have EU citizenship. Do I have to leave Germany or can I stay and start working after I have obtained the Master’s degree?

Non-EU citizens with health insurance and proof of financial means sufficient for living expenses may be granted an 18-month visa for job search after graduation. With a job there is the prospect of a residence permit or an EU Blue Card. Further information can be found on the DAAD website.

Where can I find the self-assessment and is it mandatory to take it?

The online self-assessment is available here. It is mandatory to take the assessment. However, this is not a test that you can fail: We would like applicants to assess their skills in statistics, economics and econometrics so that, if necessary, specific pre-courses can be taken.

I am currently studying in program A at University B and have taken courses in C, D and E. Am I eligible for the program?

We kindly ask for your understanding that we cannot provide an answer here. The purpose of the application process is to answer such questions. Please submit a full application such that we can consider your materials. The sooner you submit, the earlier we will be able to get back to you with a clear and definite answer.

There are still a few courses missing for my Bachelor’s degree. Can I nevertheless apply?

Yes. We are aware that your undergraduate degree may not be fully complete by the time you apply and take this into account when assessing your application. Please briefly summarize what you still plan to complete in your academic CV (resource only available during application period).

How good do my German language skills need to be?

The core curriculum and most electives are taught in English. We recommend a good command of the German language (at least B1) if you are interested in taking German-language electives.

Is it mandatory to prove my proficiency in the German language?

No. Also note that proficiency in German is not necessary for successful completion of the program.

Can you offer scholarships to cover costs of living (housing etc.)?

While we can offer the program free of tuition, we unfortunately cannot offer any scholarships for such costs. Some external agencies, possibly in your home country, may be able to assist.

There regularly are opportunities for paid positions as student research assistants, which helps cover parts of the cost of living.

Can you help me with finding accommodation?

There are several student dormitories for which Accommodation is arranged by the associated student union (Studierendenwerk). The international offices are also happy to help you to find your way around the private housing market. Further information can be found via the following links:

Is there a possibility to pursue a PhD in econometrics/statistics/economics after completion of the MSc?

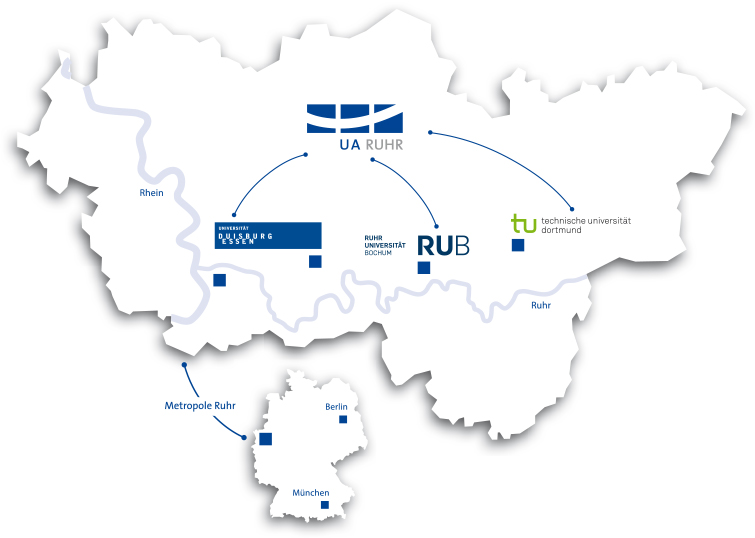

Yes. Professors at the UAR and elsewhere regularly seek qualified quantitatively trained candidates for which the MSc in Econometrics provides an excellent background.

What are ECTS points?

ECTS is for European Credit Transfer System. This system guarantees the comparability of achievements gained in the European Higher Education Area by issuing so called credit points (ECTS credits). These credit points exist to give an indication of the student’s average workload per semester or year. They do not function as an evaluation of performance. ECTS credits are only awarded if courses are successfully completed. This means that all of the relevant exams have to be passed.

When does the summer term start? When does the lecture period begin?

The summer term starts on April 1st. The lecture period usually begins in the 2nd week of the semester. Note that the lecture periods may vary between the UAR universities. Course dates and locations can be found in the online lecture catalogs:

It is often worthwhile to visit the website of the respective chair for further details on the schedule.

Which living costs should I roughly expect when studying in the Ruhr area?

You should expect to spend a minimum of €750 to €900 per month for basic expenses. The costs can be broken down roughly as follows:

- Rent: €350 to €450

- Health insurance: €110

- Food: €260

- Phone & Internet: €30 to €50

Note that the above is a minimum calculation which can be easily exceeded, in particular because rents differ significantly between different cities and districts. Also consider extra costs that you face upon arrival in Germany, some of which are the deposit for accommodation, fees for residence permit, household items etc.

Good news is that students enjoy reductions on many occasions. Student tariffs are available for mobile contracts and many leisure activities.

Do I need health insurance for studying in Germany?

Health insurance is mandatory for all students in Germany and you must present proof when you enroll. The good news is that healthcare is affordable in Germany and in some cases it is even possible to bring your own insurance. We advice you to read through the guide of the Germany Academic Exchange Service (DAAD).

I have been admitted to the program and want to attend the precourse in statistics. Where can I find more information?

The precourse in statistics is an e-learning course. Further information can be found here.

Where can I get an overview of the courses offered in the current/upcoming semester?

For a start, please refer to the interactive table above. The links in the first column point to the module manual. We recommend you to read pages 10 to 16 for an overview of the distinct module areas. Links in the last column usually direct to the respective chair’s website where further information is available. The participating faculties also provide information on their homepages. English language courses offered by the Department of Statistics in the current semester can be found here.

Where can I find more information regarding the offered courses such as schedules, rooms, important links, access keys for Moodle etc?

Links to the online course rooms, information on who to contact for the required passwords, as well as other relevant information, can usually be found on the websites of the chairs. If you find an interesting course, the first place to look for further infos is the chair’s homepage.

The interactive table above may be useful, too.

If your desired course is not yet listed in our handbook of modules yet, please contact Jan Prüser (prueser[at]statistik.tu-dortmund.de).

I completed a relevant part of my Bachelor’s degree in English. Is this sufficient proof of English language skill at the level of at least B2?

Yes, usually this is considered sufficient and does not warrant an additional language certificate.

What is the typical course schedule of a student in the Econometrics program?

There are no fixed days or parts of days on which there are no in-person classes, but that does not mean students are in the classroom all the time. Rough calculation: courses worth 4,5-6 ECTS typically have two 90-minute class sessions per week for the 15 weeks of a semester. Usually, this is one lecture and one tutorial. A schedule for full-time study corresponds to 30 ECTS per semester.

There are however modules in which you write term papers, for example, and as such these have far fewer contact hours to allocate more time towards the writing of the term paper.